It took two meetings and an alternate meeting location to accommodate the suddenly interested public before the Collinsville Township Trustees voted to increase one tax levy and keep two others stable.

Prior to the Nov. 26 Township meeting, Trustee Chris Guy placed robocalls to Collinsville Township residents to alert them to a vote on a tax levy increase, which could lead to a tax increase. The small meeting room at the Collinsville Township building used for regular Trustee meetings was overwhelmed with the turnout.

The walls of the room were lined with citizens while Township Trustees and staff sat at a table in the center of the room. The crowd extended into the hallway. The Dec. 10 meeting was moved to the Collinsville Township Senior Center to accommodate a crowd of more than 40.

The walls of the room were lined with citizens while Township Trustees and staff sat at a table in the center of the room. The crowd extended into the hallway. The Dec. 10 meeting was moved to the Collinsville Township Senior Center to accommodate a crowd of more than 40.

The agenda items of interest for both meetings were votes on increasing tax levies. At the Nov. 26 meeting, two votes were taken; one for increasing the Road and Bridges tax levy and one for no increase in the Town Fund.

An increase of 4 percent for the Road and Bridge fund passed at the Nov. 26 meeting. Guy, in keeping with a campaign promise to not raise taxes, was the lone dissenting vote. A vote for a 0 percent increase in the Town Fund, which was said to include the General Assistance Fund, ended in a stalemate.

Guy and Trustee Mike Foley voted for no increase in the Town Fund. Trustee Dennis Hill and Township Supervisor Terry Allan voted against the motion for a 0 percent increase. Trustee James Stack was not in attendance, so the motion was deferred to the Dec. 10 meeting.

The Township Fund was split into two votes at the Dec. 10 Township meeting. A vote was held to keep the tax levy for General Assistance portion of the Township budget the same. The motion passed unanimously. Separately, a motion was heard to keep the Township Fund levy the same for 2014. The motion passed by a vote of 3-2, with Guy, Foley and Stack in favor. Hill and Allan voted against the 0 percent increase.

According to the County Clerk’s Office for Madison County, Collinsville Township residents will pay $1,380,329 in property taxes to the Township for operations separate from roads and bridges in 2013. Of that, $159,970 was targeted for General Assistance. Collinsville Township includes most of Collinsville and Maryville, portions of Pontoon Beach and Glen Carbon and nearby unincorporated areas. Those amounts will remain the same in 2014.

As a result of the Roads and Bridges tax levy increase, Collinsville Township residents will pay $1,260,667 to the fund in 2014, up from 1,2121,80 in 2013. Until all tax levies from all governing bodies have been filed and property values assessed, the impact of an increased tax levy from one taxing body will not be known. This process should be completed in April or May, a spokesman for the Madison County Treasurer’s Office said.

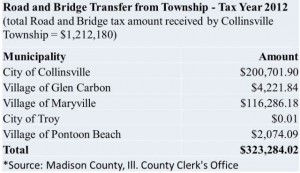

Not all money collected for Roads and Bridges is received by the Township. In 2013, $323,284.01 was transferred to the four primary communities within Collinsville Township (Troy received $.01). Collinsville received $200,701.90, Maryville $116,286.18, Glen Carbon $4,221.84 and Pontoon Beach $2,074.09. In 2012, the total was $314,094.95 amongst the four municipalities.

With the remaining $888,895.98 in 2013, the Township maintained 94 lane miles of roadway. Other services provided include limb mulching at residents’ homes, appliance and scrap metal pickup and curbside leaf vacuuming. These services are only provided to residents in unincorporated Collinsville Township.

In comparison, the City of Collinsville maintains 261 lane miles and 71 miles of sidewalks. The City of Collinsville’s Street Department budget for 2014 is about $1.7 million. City residents do not receive free limb mulching or curbside leaf vacuuming.

Collinsville Township property taxes are collected from property owners in the township, regardless if the residence or business is in an incorporated or unincorporated part of the township.