Marleen Suarez, candidate for Madison County Treasurer, released a statement Monday criticizing the history of failed inspections at a St. Louis day care owned by current treasurer, Kurt Prenzler.

Kurt Prenzler at a news conference he arranged on May 30 at the St. Clair County Administration Building / Photo by Roger Starkey

“While Mr. Prenzler is running around other counties warning of ‘patterns’ in his slander of innocent public servants, he failed to correct alarming problems in his own business,” Suarez said in a released statement. “How can voters trust Mr. Prenzler to be a good steward of their tax dollars when he can’t even keep his business in compliance with the law?”

Prenzler held a press conference in St. Clair County on May 30 to show what he called four “patterns” of similarities between the tax sales in 2006 and 2007 of former Madison County Treasurer Fred Bathon and current St. Clair County Treasurer Charles Suarez. Bathon began serving prison time in January after pleading guilty to allowing three campaign contributors to buy delinquent taxes without competition.

Prenzler did not return phone calls for comment on Marleen Suarez’s accusations, but did issue an emailed statement. In the statement, Prenzler called his opponent’s allegations unfair, saying his opponent four years ago, Frank Miles, made similar attacks.

“The fact is that day cares are rigorously inspected. That’s a good thing, and I’m in favor of it,” Prenzler said. “The majority of ‘violations’ were minor.”

Suarez said the failed inspections only remain an issue four years later because they continue to occur.

“If there had not been new violations, then I would say it was old news,” Suarez said. “The fact is that four years later we still have violations and this continued pattern of misconduct shows disregard for sound business practices and the safety of children put in his care.”

Among the 86 violations accumulated over the past two years – the most recent 33 coming in May 2014 – Suarez noted as the most egregious a Nov. 2013 violation in which Good Shepherd Academy, at 5500 Virginia Ave. in St. Louis, was cited for failing to have background checks on file for six employees, including Prenzler.

While praising the next door Iron Barley restaurant as excellent, Prenzler also intimated that the establishment may be to blame for the pests violations at Good Shepherd Academy in May 2013.

“The Iron Barley has outdoor dining, which can attract pests,” Prenzler indicated. “You will note that the following two inspections did not find similar violations.”

According to City of St. Louis restaurant inspection records dating back to 2009, and covering 20 inspections, Iron Barley was never cited for the presence of pests. At Good Shepherd, inspectors found evidence of rodent droppings and roaches throughout the facility in May 2013. The following five inspections, according to the Missouri Department of Health and Senior Services, did not find any similar violations.

Prenzler acknowledged that the childcare institution has been cited, but said the facility focuses on correcting issues.

“The day care doesn’t dispute violations, but instead, corrects the violations within 30 days,” Prenzler said. “The November 2013 ‘re-licensing’ inspection is more thorough.”

According to publicly available records, since Nov. 2012 Good Shepherd has not passed an inspection during which a person was present to inspect the facility. During the Nov. 2013 inspection, which was announced prior to the visit, the facility was cited for 21 open violations.

Three of the 10 inspections since Nov. 2012 have found the day care to be in compliance. Each time Good Shepherd was in compliance, the corrections for violations were verified through submitted documentation, not an onsite inspection.

Accusations are a diversionary tactic

But the issues with the childcare facility he owns are nothing more than an attempt by Saurez to deflect from Prenzler’s record as treasurer, he said. In the emailed statement, Prenzler said he “exposed and fixed the tax sale scandal, which cost Madison County taxpayers $4.5 million (lost homes not included).” Prenzler previously told the Metro Independent that Miles had run a “clean” tax sale the year before Prenzler took office.

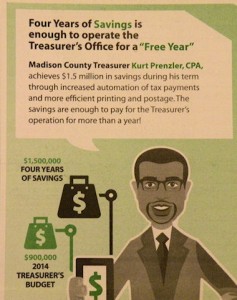

Prenzler indicated that he improved services in the treasurer’s office while reducing costs by 30 percent and saving taxpayers $1.5 million. It is unclear how Prenzler reduced costs or improved services. All requests for comment and clarification after receiving Prenzler’s emailed statement have gone unanswered.

In statements made to the Alton Telegraph in response to a Metro Independent article for which he did not return requests for comment, Prenzler indicated that he has reduced management staff to five and one half employees from nine and reduced non-management staff to six employees. Cynthia Ellis, the financial services manager in the Treasurer’s Office, is the editor of flaire FOR WOMEN, a monthly publication distributed by The Telegraph in Alton.

Since Prenzler took office, he “exposed (the) former treasurers’ scheme where they purchased a half-billion of risky bonds from one Little Rock, Ark. bond salesman,” he said. The bonds in question were purchased by Bathon from Sterne Agee and Leach Inc.

Suarez does not agree with Prenzler’s assessment of risk.

“Those were AAA rated government bonds,” Suarez said. “The only person in the country who calls those risky is Kurt Prenzler.”

Prenzler sold the bonds because they had a maturity longer than 10 years, which he said violated internal office policy. The sale of the bonds has made Prenlzer a lightning rod for criticism from Democrats, who claim the decision to sell early has cost taxpayers over $500,000.

Suarez’s plan

Suarez, Prenzler said, has not discussed her plans if she wins the November election.

“So far, my opponent isn’t telling taxpayers what she will do differently as treasurer, but instead, making personal attacks that have nothing to do with running the office as treasurer,” Prenzler said.

One change Suarez said she would make, is to have someone, either within the office or an outside professional, whose primary job is to focus on investments.

“If you don’t have someone, that is almost unethical to me,” Suarez said.

Emails and phone calls to Prenzler’s office requesting information about a person or group who may assist with his investment strategy went unreturned.

Madison County Auditor Rick Faccin and Madison County Board Chairman Alan Dunstan have called for oversight of Prenzler’s investments, saying the rates of return are so small such as to be a disservice to the taxpayers. At the June Madison County Board meeting, Dunstan said the current rate of return for Madison County investments is .21 percent.

Prenzler has questioned the need for oversight and questioned why the Treasurer’s Office did not have more oversight during the Bathon administration. According to a report provided by Prenzler at the June Board meeting, of more than 50 funds invested, the highest rate of return was 1.1 percent.

Suarez also chided Prenzler’s investments, saying he does little more than invest in certificates of deposit and bonds. There are ways to be safe, to stay within the investment policy and maximize the rate of return, Suarez said.

“The main focus of my job as treasurer will be to shore up our investments so that we are maximizing our investments as safe as possible, but as much as possible,” Suarez said. “It’s easy to just buy CD’s, as Prenzler has done, but that does not generate a good rate of return. There is a place for CDs, absolutely, but they have a place. He has consistently taken the easy way out.”

At a June 26 press conference at the Madison County Administrative Building, Suarez also said she would better communicate the many programs the County makes available to low income residents. The programs, Suarez said, are designed to assist taxpayers before they fall too far behind on their taxes and become part of the tax auction process.

“I won’t use the back of the tax bill to promote myself,” Suarez said. “I will use that space to advertise programs for the taxpayers’ benefit.”

A complaint against Prenzler was referred to the Madison County ethics advisor in June, in part, because of information contained on the back of the 2014 tax bill touting Prenzler’s accomplishments while in office.

Statement of Economic Interest

In 2006, Prenzler took issue with Bathon not including his homebuilding business on the Statement of Economic Interest each elected official and candidate for public office is required to file. In the 2014 Statement of Economic Interest filed by Prenzler, he did not include Good Shepherd Academy. Prenzler did not return an email requesting an explanation for the omission.

Suarez’s statement, filed in Dec. 2013, included her law office, property she owns with her husband and property owned by a company in which her husband is a one-third partner.

The comment provided by the person using the name John Miller has been removed.

The Metro Independent discovered that the email address used was a false address.

Per Metro Independent policy, for all comments posted on the site, a valid email address must be used and statements cannot be defamatory, racist or sexist.

The email address of commenters is not visible, but must be provided. Only the Metro Independent has access to the email address provided.

When a comment is posted that is not within guidelines, The Metro Independent will attempt to remove it promptly. However, there may be times when it is necessary to contact the person who posted the comment.

I get a kick out of Prenzler math, first he claims that (non)tax payers lost $4.5 million by Bathons actions, of course, as he ALWAYS DOES, he adds the things that make him look good and doesn’t subtract the things that make him look bad and tell the TRUTH. The FACT IS, the only reason the taxes get sold, is because THEY DIDN’T PAY THEIR TAXES, with a ZERO percent interest if they had paid to begin with and he ignores that HE, as Treasurer assesses a penalty EVERY DAY they are late, so under NO CIRCUMSTANCES are those people getting off with no penalty even if bought at 0% at the sale, but OF COURSE, no one should know that. He claims that EVERYONE who didn’t pay their taxes, would have miraculously paid their taxes, frankly that’s A LIE, and a provable LIE, records from years prior to Bathon would prove that, yet he pretends THOSE RECORDS don’t exist, not even now for current sales. He has ILLEGALLY used his office and employees to play politics, after caught, he admitted that and pretends because he got caught, it’s all politics on the part of others, he refuses to accept responsibility for HIS actions. I do note he doesn’t include the tax sales records of counties ran by his buddies he calls on when he needs back up for his actions. DID THEY have a lot of 18% tax sales in past years, he won’t ask, because he doesn’t want those answers. The question to be answered now is how many times, how many $thousands$ of tax payer money, and who he has used and abused in his past activities illegally. I can think of several “Prenzler events” where he has showed up with Prenzler math, that someone came up with, is he going to pretend he did that at home in spite of his recent past history.

Prenzler should resign if he believes in the Code of Ethics he posts on his personal web site, he violates his own ethics, the Counties ethic law, and the trust of every tax payer in Madison County. We want the truth, not Prenzler math and Prenazler spin, and Prenzler lies.