Every day thousands of Baby Boomers turn age 62 and become eligible to receive Social Security benefits. The dilemma they face is taking the money immediately or waiting.

For those who can afford to wait, doing so could result in hundreds of thousands of extra dollars over a lifetime. There may also be unique strategies to employ for added benefits.

For those who can afford to wait, doing so could result in hundreds of thousands of extra dollars over a lifetime. There may also be unique strategies to employ for added benefits.

Each situation is unique, which can make the decision — which is often irreversible — a complicated one.

The Basics

Social Security began in 1935 at a time when the poverty rate among those over age 65 was a staggering 50 percent. Workers contribute 6.2 percent of their income to the system (up to the cap limit) and employers match this amount.

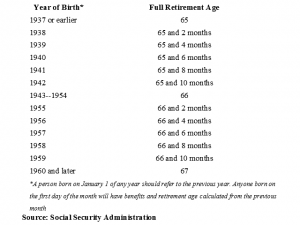

Benefits are based on the highest 35 years of earnings. Workers can start collecting at age 62, but doing that could result in as much of a 30 percent reduction in benefits. Full retirement age is between age 65 and 67, but benefits can be delayed until age 70 to receive a higher payout. For example, those born in 1943 or later will get an 8 percent credit each year collection is delayed, according to the federal government.

Concerns about Social Security solvency

The concern over the solvency of the Social Security system has contributed to many Boomers opting to take reduced benefits at age 62. Although Social Security has run a surplus for the nearly 80 years of existence, the trust fund is beginning to run a deficit due to an increased number of retirees, longer life expectancy and fewer active workers contributing to the system.

According to the Social Security Administration, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted. When the reserves are gone, continuing taxes are expected to be enough to pay 76 percent of scheduled benefits. The Social Security Board of Trustees project that an increase in the combined payroll tax rate from 12.4 percent to 14.4 percent would be sufficient to allow full payment of the scheduled benefits for the next 75 years.

Strategies

People who need the money to help pay living expenses, or those in poor health, may opt for the early, reduced, benefit at age 62. For singles, the decision to take benefits early or wait is simpler than those with spousal benefits to consider.

For married couples, evaluating the decision of when to begin taking Social Security benefits can be difficult because there are dozens of strategies available. Couples may get more from their Social Security benefits by timing which spouse files first, ensuring that the higher earner delays benefits until age 70.

For married couples, evaluating the decision of when to begin taking Social Security benefits can be difficult because there are dozens of strategies available. Couples may get more from their Social Security benefits by timing which spouse files first, ensuring that the higher earner delays benefits until age 70.

The “file and suspend strategy” helps spouses with a large difference in the size of their benefits. When the highest earning spouse reaches full retirement age, the person files for benefits and immediately suspends them, waiting until age 70 to get a higher benefit. The lower earning spouse begins taking the 50 percent spousal benefit immediately, and begins taking their own benefit at a later time to receive a higher amount.

“File and Suspend” Example

Bill and Nancy, a married couple, have reached their full retirement age of 66. Bill is retired while Nancy plans to keep working until she is 70. Nancy, who has had a larger income than Bill over the course of her career, files for full retirement benefits of $2,000 a month, but immediately suspends payment. Her retirement credits will increase 8 percent annually to about $2,640 at age 70. Benefits do not accrue past age 70.

When Nancy filed for her benefits, she automatically activated Bill’s ability to apply for a spousal benefit. Social Security rules provide that a spouse, whether the person ever worked, is entitled to a benefit equal to up to one-half of the other spouse’s retirement benefit. So Bill can collect $1,000 a month. But something else will also be happening: because Bill is not taking his own retirement benefit, he will also accrue delayed retirement credits that will boost his own retirement benefit when he applies for it in the future.

So, as Bill and Nancy await the day when they activate their higher retirement benefits, they have a $12,000 a year cushion in the form of Bill’s spousal benefit.

Divorcees and Widows

Divorced spouses are eligible for spousal benefits as long as the marriage lasted at least 10 years, they are still unmarried, and are at least 62 year-old. Widows can begin collecting a survivor benefit as early as age 60.

Deciding how and when to file for Social Security benefits can be a daunting task due to the myriad of unique circumstances at play. Other factors to consider are the taxation of Social Security, pension offsets, and reduced benefits for those still working.

For those planning to take the money and run at age 62, perhaps this column will whet your appetite to explore more options. A visit to your local Social Security office is not a bad idea, but do not expect them to give you advice or recommendations on unique strategies.

Brad Keene is a Wealth Management Advisor, Portfolio Manager at Visionary Wealth Advisors. He is a CERTIFIED FINANCIAL PLANNER (TM), holds an MBA from St. Louis University and a B.S. in Finance from Eastern Illinois University. He has been advising clients since 1996 and is a lifelong Collinsville resident. Contact Brad at brad.keene@vwa-llc.com